To get into the business of website investing, you need to know how to determine a site’s value. Whether you want to make an offer to purchase a site or set a price to sell your site, you’ll need to know its worth. So I wrote this article as a primer on website valuation. While it only covers the basics, after reading it you should have an idea of how to determine a site’s value.

If you’re in a rush and want a rough estimate of website valuation, you can follow this rule: on average, a website sells for 30 to 50 times its monthly profits. Where a site ranks of that scale depends on a number of factors. A site that exhibits a pattern of increasing revenue and traffic will be closer to the 50x multiplier, while a site that’s a bit down in revenue and flat in traffic will generally sell for closer to 30x.

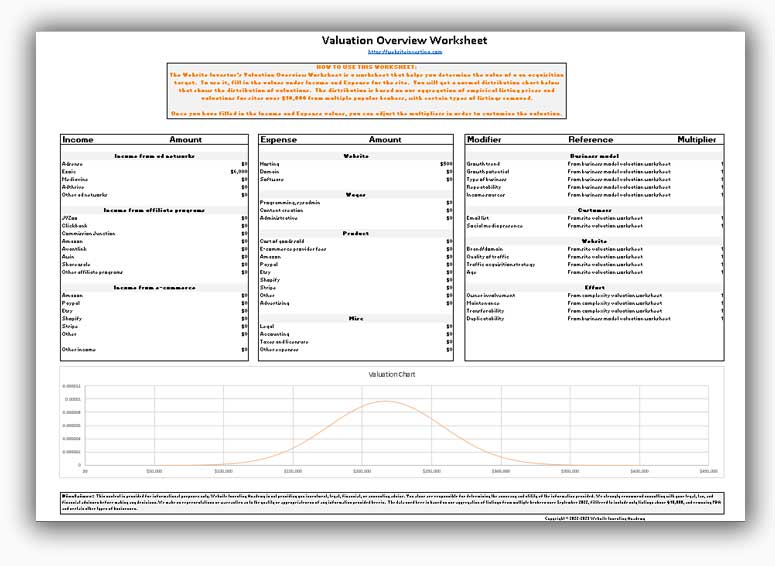

At the end of this article, I have included the Valuation Overview Worksheet, which is available for download for FREE. It uses real website listing data to provide a valuation for your website based on multiple parameters.

Table of Contents

- Introduction to website valuation

- Using my valuation worksheets

- Website valuation factors

- Download the Valuation Overview worksheet

- Key points

Introduction to website valuation

When you visit a broker, you’ll notice a common trend. Website owners often overvalue their sites. That’s because they’re taking into account all the personal effort they put into growing their brand. They’ve made an estimate based on emotional investment instead of objectively evaluating the assets the site offers.

Regardless of whether you’re a buyer or a seller, you need to understand how to perform accurate valuations.

Website valuation is more of an art than a science, and different brokers and buyers can have quite different valuations of the same site. The basic rule of valuation is that a website is worth anywhere between 30 to 50 times its monthly profits. But where a website falls on that 30-50x range is dependent on a number of factors.

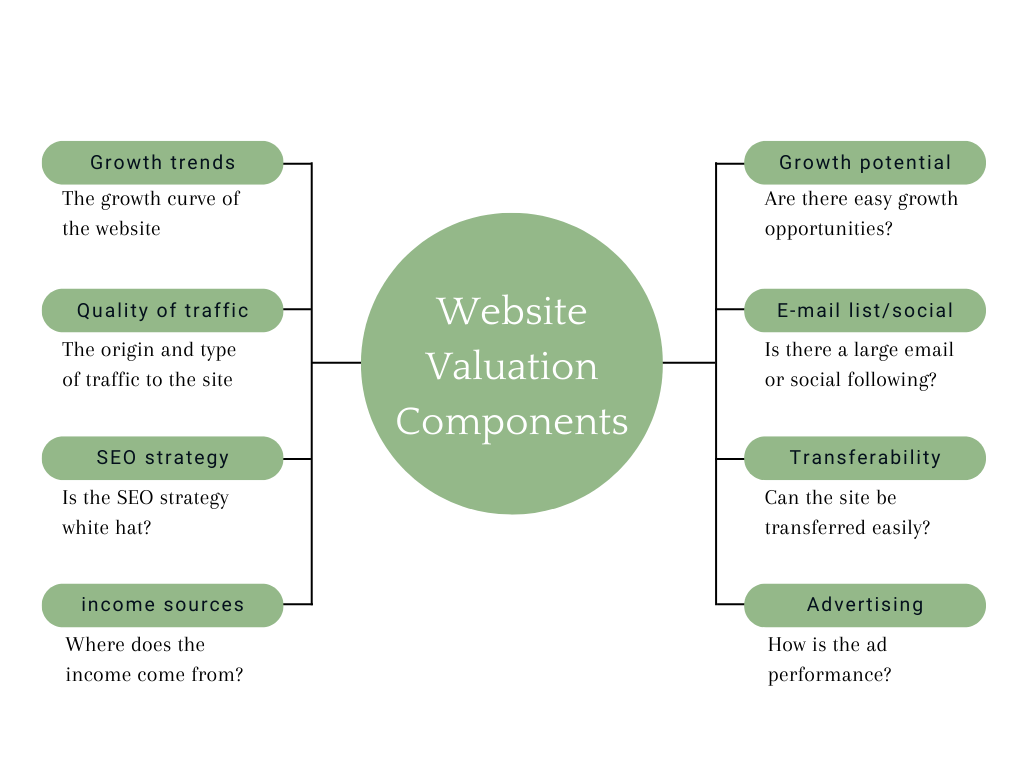

The most important of these website valuation factors (as well as due diligence factors) are growth trends and quality of traffic, but there are several other factors as well, and in the rest of this article I will examine each one in depth.

Using my valuation worksheets

To help website investors with valuation, we have developed a series of valuation worksheets. Using data on hundreds of current websites for sale across brokers, these worksheets provide valuation quantiles based on empirical data.

Below you can fill out the form to download the Valuation Overview worksheet for free. This worksheet takes into account income from ads, affiliates, and e-commerce, expenses, and the valuation affecting criteria above to give you a statistical distribution of the valuation of any website.

In the sections below, I explain the factors that go into a website valuation. These factors are included in the worksheet, so you can follow along with them if you choose.

Website valuation factors

Growth trends

Upward trends for traffic over a relatively long period can significantly increase website valuation. These trends can be found by analyzing a site’s Google Analytics reporting, and looking for two specific things:

First, you need to look at the Google Analytics traffic from recent months. Part of a site’s value is how much audience it has at the time of sale. By looking at historical traffic trends, you can eliminate the possibility that the site is on a downward turn. If the site faced a Google penalty or is losing business to a new competitor, the analytics should show that. Downward trends reduce the value of a website, because they mean the new owner is likely to earn less profit than the current owner.

Second, you should check the longer-term Google Analytics data (from the past year or two). If a site is only a few months old, it is less valuable and harder to sell. The more data an owner has for traffic and revenue, the better positioned they are to demand a high price. A website with two or more years of data is worth much more than one without. A site with two full years of traffic history showing a consistent upward growth trend will have a high price.

Quality of traffic

Google Analytics records, however, don’t tell the whole story. To make a good website valuation determination, you also need to look at earnings. That means factoring in income reports, such as AdSense reports, Ezoic records, PayPal reports, and affiliate commission statements.

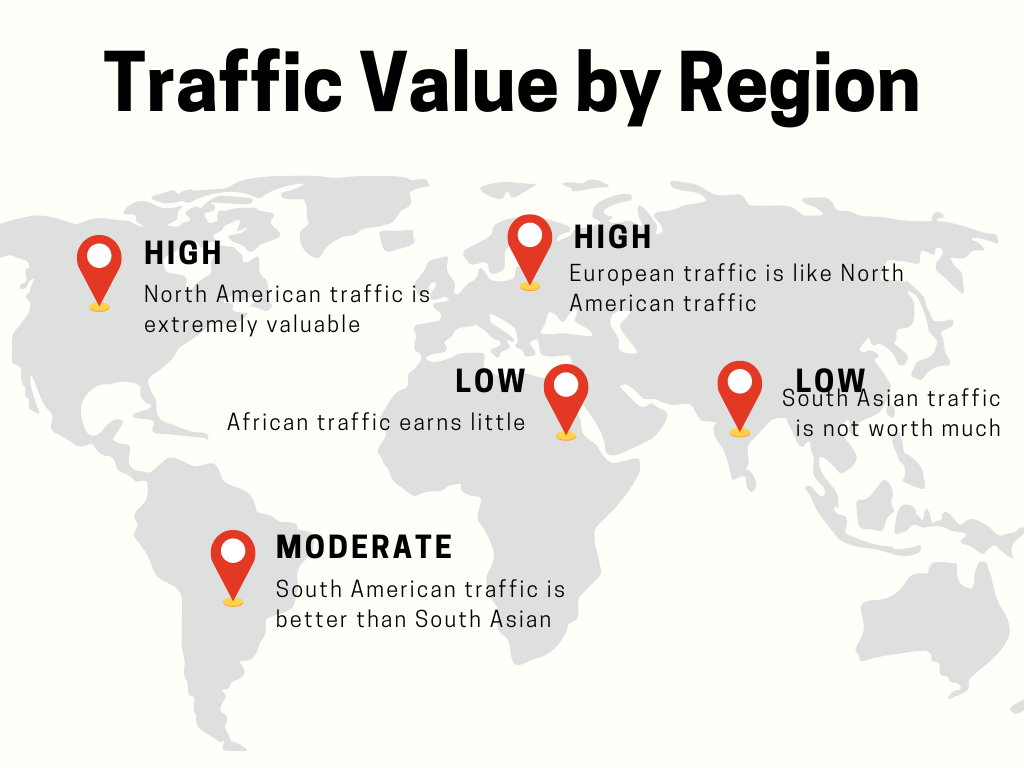

Much of a website’s value is based on the quality of its traffic. Traffic that doesn’t convert to sales is worth much less than traffic that does convert. So a site about motorhome reviews for a U.S. audience is going to be worth more than a gaming site for an Indian audience.

Looking at income reports, you can analyze the quality of the traffic. If the site is an ad supported site, this will be reflected in the RPM. For an affiliate site, this will be reflected in the conversion rate. These metrics answer the question of whether the site is reaching its target audience and converting them into buyers.

If an affiliate site has high traffic and low sales, that’s a red flag. It shows that the website isn’t reaching its target market. As a result, the audience is worth a lot less. A new owner can change the marketing strategy or add SEO value. But, if the viewers don’t buy, there is no solution, and it’s extremely difficult to alter the audience of a site.

Sustainable SEO strategy

A website sells for a higher price if it has a sustainable SEO strategy — and conversely, it sells for a very low price if it uses black hat SEO techniques.

When a site uses pure white hat SEO techniques, it’s more valuable, since these techniques will not result in any future search engine penalties. Link building by guest posts and outreach increase the website valuation.

In contrast, black hat techniques such as buying backlinks and PBNs hurt the value of a site, because they mean the site may be penalized in the future. A site that gets penalized by a search engine will lose a significant percentage of its traffic overnight.

Beyond black hat/white hat SEO, you will want to look at a site’s keywords and understand how their rankings have changed over time. When the keywords used keep their position in the rankings with little upkeep, it means a site is worth more. A new owner can sustain these profits at a low cost and with little effort. And the net revenue is a lot more than what you’d get from a different strategy like paid advertising.

Multiple income sources

Is all, or most, of a website’s profits because of one product, one page, or one affiliate? If this is the case, the website will be less valuable, since it poses a significant risk to the business.

If a site has high traffic, high revenue, but only one sellable item, it can be a bad investment, because what happens if that product loses value or becomes obsolete? The site goes bust overnight.

Similarly, if an ad supported or affiliate site has most of its traffic coming from one (or a few) pages, it means the site’s value is lower, since a Google ranking change can severely affect the site’s income. And if an affiliate site gets all of its income from one affiliate partner, that poses a risk if the partner closes or changes its affiliate terms.

The more sales opportunities a website offers, the higher its value. Any website with multiple revenue streams costs more. A site should have at least 2 revenue streams, but 3 or more is ideal. Additionally, whether site is trend-based or evergreen has an impact on value since if you think a site will lose profits over time, current profits don’t matter.

One thing that will hurt the valuation of a site is excessive use of sponsored posts. It’s important to determine the number of sponsored posts — and how they factor into the revenue numbers.

Growth potential

Growth potential is a subjective component to the value of a site, which may be different for different buyers.

The prior factors make up the objective value of a website, which is the same for any buyer. However, in some cases, a certain site is worth more a certain buyer for personal reasons. Often this happens when a buyer already owns a site in a particular niche and plan to combine the sites. If this is the case, then it may be worth while for that buyer to spend more money than another buyer because the site is worth more to them.

There are many reasons why such a purchase can have growth potential for a certain buyer. For example, a buyer may purchase a site as a “sister site” where he/she you can cross-market products and double sales. Alternatively, if a website has an active user base but does not make significant profits due to being under-monetized, a buyer may want to spend more money for access to the user base.

At the end of the day, this is a subjective factor. How badly you as a buyer want a certain website should play into your final decision, but only if it will directly impact your future profits.

Active email list

When it comes to website valuation, profits and traffic are top level factors: they’re immediately visible and important. But additional value can be found in the things that support the marketing power of a business. And nothing bumps up the marketing power of a website more than an active email list.

A mailing list draws in viewers so you can build traffic and push products. It can mean re-marketing to old users — far into the future. But the list has to be monetizable.

When you’re buying a site, you have to find out if the mailing list is a part of the deal. If it isn’t, ask for it. A quality email list will increase the value of a website, even if other factors aren’t being met.

Social media presence

Having a strong brand identity also helps website valuation. Similar to an email list, a good social media presence can help to remarket to past users, but it can also bring in new users (and thus, buyers). If a business has a strong social media presence and can interact with its viewers to create a strong brand identity, they can sell to them again and again. That relationship between a website and its audience is very valuable.

However, a strong social media presence only adds value to a site if it can be monetized. Like previous factors, a social media presence only increases the value of a website if profits can be traced back to leads generated from social media.

Before you buy a site, you need to find out what the social marketing methods are and confirm that these accounts are a part of the sale.

Advertising

A lot of websites depend on advertising to increase their profits. But, when it comes to website valuation, using paid advertising lowers a site’s value. This is another example of why it is crucial to know how a website is making money.

If all of a site’s profits are due to a massive ad budget, the value of the site is suspect. A buyer wants a site that makes profits at little cost for upkeep. A site that requires paid advertising instead of quality SEO, a huge social media presence, or an active email list is less desirable.

Often, site owners using paid advertisements with high profit and traffic values may try to sell their site at a marked up rate. If you haven’t looked into whether those numbers are solely off advertisements, you will lose money on a bad investment.

Transferability

A website valuation factor that is often overlooked is the site’s ease of transferability. If you’re buying a website, can the owner simply hand over the reins? Or will it involve the transfer of vendors, assets, workers, freelancers, and other resources? A site that can be transferred easily is more valuable than one that can’t.

Some of the things that factor into transferability are:

Will a buyer need a handover period where the old owner shows trains the new one? How will this affect the running of the site? Is the current owner handling tasks that require technical knowledge that you don’t have? Can those tasks be outsourced? And how much will that cost? You have to ask all of these questions before you decide to buy a site.

If a website requires outside workers and they don’t plan to continue working, this hurts the value of the site.

Another important but often overlooked question is what platform the site uses. Is it WordPress, or will a buyer need to deal with the hassle and expense of setting up a new CMS? If the site is on a basic plan, does hosting need to change as well? Was the domain bought through the site builder or independently? If the platform is restrictive, it can become near impossible to change, and buyers will lose a lot of money in the process. A website that can be handed over without issues is worth slightly more.

The final aspect to consider is whether the sale will affect customers. For some sites, the clients never need to find out the site changed hands because the product remains the same. However, for others, the process can affect sales and profits. Find out whether the owner used a personal approach to market their brand. If a site’s marketing strategy is based around the owner’s Facebook Lives and IGTV videos, a change will disrupt the entire process.

Owner effort required

As a buyer, you have to take into account how much time you’re going to put into your website. It’s easy to look at an earnings report and convince yourself its the business for you. But owning a website isn’t easy. If a current owner is putting in eight hours a day, you will need to do the same to make their projected profits. And if you cannot, then their site is not the one for you.

Download the Valuation Overview worksheet

Want to use the Valuation Overview worksheet to determine the value of a site you’re interested in? You can get the Valuation Overview worksheet, along with several other useful tools by requesting a free Website Investing Beginner’s Kit below.

Key points

Website valuation may be more of an art than a science, but there are some easy-to-follow guidelines that can help you get a good idea of what a site is worth. Most profitable sites are worth between 25 and 50 times their monthly income.

Although brokers want to convince you that everything is worth 50x, the actual value tends to be around 35x. However, the exact multiple will depend on many factors, and the true value of any site is what a buyer will pay for it.