Ready to buy a website but don’t know how to do the necessary due diligence? I’ve written this article to introduce you to the website due diligence process, so you can do basic due diligence research.

Table of Contents

- Introduction

- When to perform due diligence

- Using my due diligence worksheets

- Pre-offer due diligence research

-

Post-offer due diligence research

- Do the sales and income statements match the seller’s reported numbers?

- Are the expenses consistent with the seller’s numbers?

- Is there any intellectual property infringement?

- Is there written confirmation of any continuing agreements?

- Has the website faced any penalties or bans?

- What platform does the website use?

- CMS systems

- Website builders

- Can you improve on the business?

- Transfer due diligence

- Download the Due Diligence Overview worksheet

- Key points

Introduction

If you’re a creative thinker looking to make money online, you have a lot of options. And if you’ve decided to get into the business of website investing, it means you’ve done your research. Getting started on buying a website is easy and only takes some basic know-how. It’s what comes next that determines whether you get a return on your investment. If you want to make profits, you need to know what to look for in a website.

The biggest mistake you can make is to jump in and buy the first interesting site you find. Your goal isn’t to own a fun site. What you’re actually buying is a business, with customers, products, a brand image, a social media presence, and an email list. If there are any employees, freelancers, or other resources onboard, then you want those too.

So in order to ensure you get what you’re expecting, you need to be able to do your due diligence before purchasing. This means you have to fully understand the intricacies of the business, it’s traffic and user base, and its revenue and cost model.

When to perform due diligence

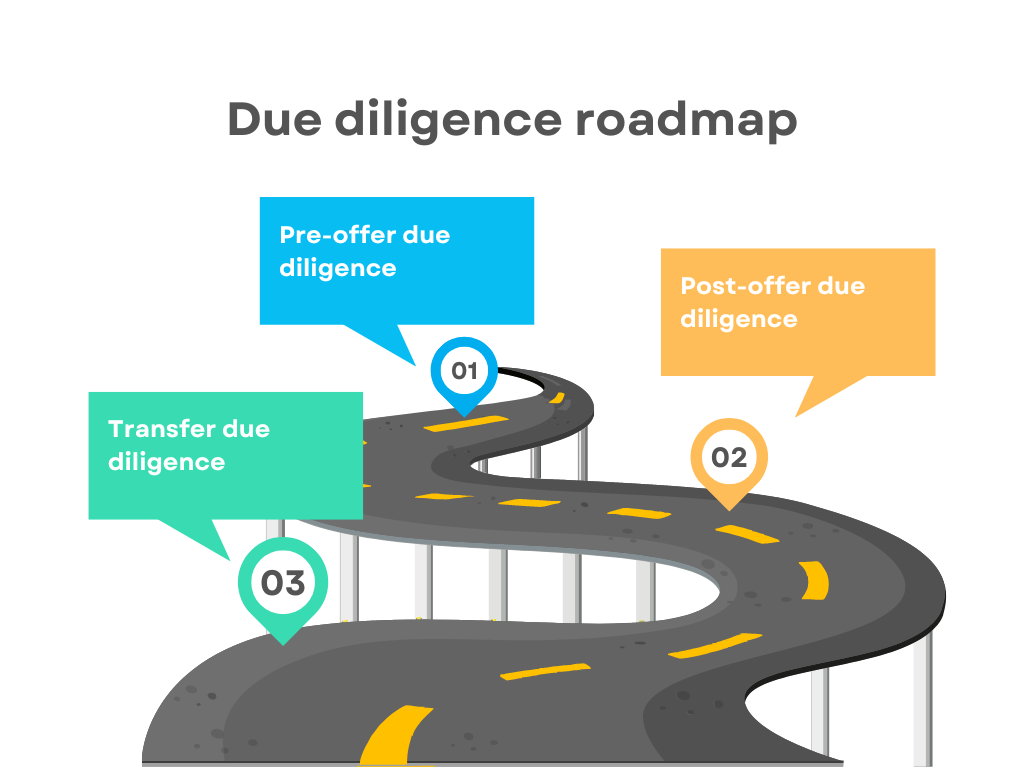

When you purchase a website through a broker (and sometimes through a marketplace), you will have a due diligence period after the initial offer, during which you will get access to all of the details of the business.

However, you should never start your due diligence at that point. A successful website investor begins his due diligence as soon as he sees a site that piques his interest. If you wait until the due diligence period, you are often too late. By that time, you will have initiated the sale process, and there is an expectation that you will complete it. Brokers don’t look too kindly on buyers who pull out of a sale after the LOI (letter of intent).

If you purchase a site using some marketplaces or if you make an offer directly to the site owner, you won’t get a real due diligence period after the offer. You will need to get all of the information you need prior to making an offer.

Regardless of where the website is listed, a smart investor begins due diligence as soon as she finds a site and continues until closing.

Using my due diligence worksheets

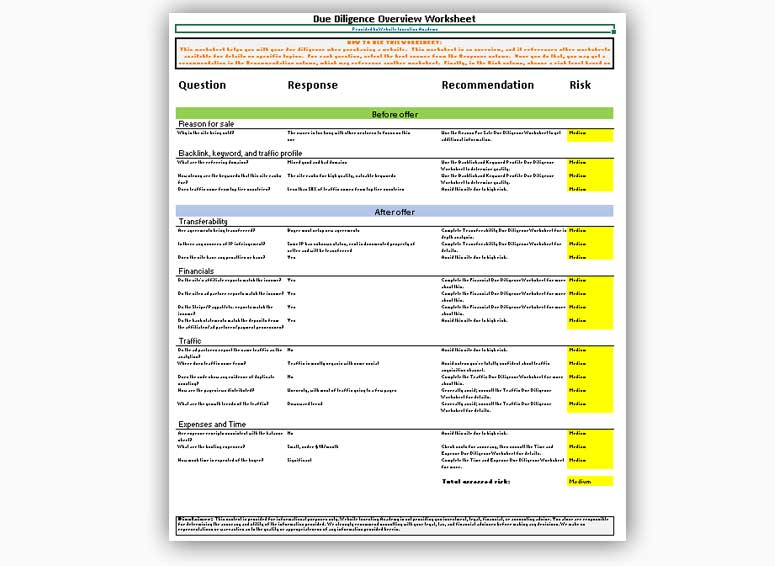

I have developed many due diligence tools over the time I’ve been investing in websites. The most important one is the Due Diligence Overview worksheet. This worksheet is a crucial starting point to performing a thorough due diligence analysis on a website.

And in order to help you get started with website investing, I am making this worksheet available for FREE. All you have to do to get it is fill in the form below.

In the next several sections, I explain all of the components to a thorough due diligence analysis. Many of them are incorporated into the Due Diligence Overview worksheet, although some require additional in-depth topic worksheets.

If you have downloaded the Due Diligence Overview worksheet, you can follow along with the sections below.

Pre-offer due diligence research

As soon as you identify a website that is of interest, you should begin the due diligence process. Although you may not have access to all of the income records at this point, you will have enough information to get started.

During this pre-offer period, you should seek answers to the following questions:

Why is the site being sold?

Asking the owner why they’re selling their website is extremely important. Typically, you will get one of these responses:

- The owner is too busy with other ventures to focus on this one

- The owner is looking for cash (to start a different business or do something else)

- The owner has a personal issue and is no longer able to run the business

Whatever the owner’s response is, you should try to verify that the response is consistent with other information you can find online about them.

For instance, if an owner says he’s starting another venture, see if you can find out what that venture is — either by asking the owner or by looking at his/her LinkedIn. If the owner tells you he’s selling the site because of a personal hardship, find out if the seller has other sites and whether those sites are being sold as well. If they’re not, something’s wrong.

Also check that the owner’s reason for selling is consistent with the rest of the website’s listing. If an owner says that he is selling because he doesn’t have time to focus on this site, but the site’s listing says the amount of work needed is miniscule, something may be wrong.

What is the backlink and keyword profile?

Before even requesting access to the site’s Google Analytics data, you should do some research on your own. With a tool like Ahrefs or Semrush, you can do quite a bit of research on a website, just by knowing the domain name. While these sorts of tools are expensive, they pay for themselves many times over when they save you from buying a bad site.

The two things you want to learn about using these tools are the quality of the site’s backlinks and the keyword profile for the site. A site with low quality backlinks is just waiting to be demoted by Google. And if the keywords that a site ranks for aren’t good and diversified, the site may lose value in the future.

Using a research tool

I have written an entire article on due diligence with Ahrefs available elsewhere on this site, but for the purposes of this primer, there are a few specific reports you can run to get an understanding of the site’s backlink and keyword quality. (This section references Ahrefs, but any other tool can be used similarly)

- Run a “Referring Domains” report on the site. This report will give you a sense of the site’s backlink profile. In this report, look for unusual sounding domains, or domains that look like they may be spam. If the domain has an excess of spammy backlinks, the site may be using black hat SEO techniques, and may lose rankings with the next Google update. This report also helps check for 301 redirects, which aren’t bad, but may be worth knowing about.

- Run an organic search “Top Pages” report on the site and look for how many pages are actually ranking well in Google. If there are only a couple of pages that are getting all of the traffic, the site may be too risky. You want to have traffic diversified as much as possible.

- Run an “Organic Keywords” report to see what the site ranks for. Ideally, you will see a number of different keywords bringing in traffic. If there are only a few keywords bringing in the majority of traffic, the site may be too risky to purchase. If Google changes the rankings for one top keyword, it could dramatically change your income.

While these three reports will give you a good sense of the backlink and keyword profile of the site, there are many other reports you can (and should) run with Ahrefs or Semrush which will assist you in your due diligence. Check out my full article on “Due diligence with Ahrefs” for more.

What is the traffic profile?

Most sellers or brokers will give you read access to their Google Analytics before you make an offer — if you ask. Don’t wait until the post-offer due diligence period to get this. ask for it as soon as you decide you want to learn more about the site. You can give your Google account email address to the seller, and the seller can then add you as a read-only viewer for the site’s analytics.

There are many articles on this site that focus on advanced due diligence with Google Analytics. For this article, I will just give some quick bullet points regarding what you should look for:

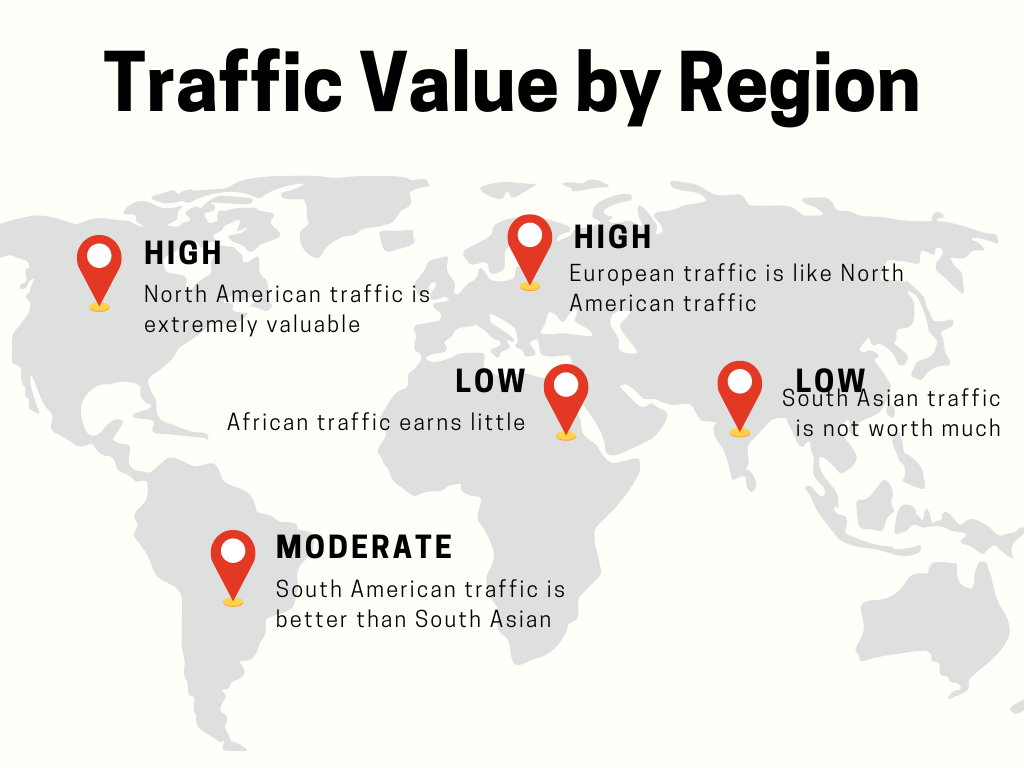

- Check the Geo report to ensure that most of the traffic comes from top tier countries (U.S., U.K., Canada, etc.).

- Check the Acquisition overview to ensure that most of the traffic is organic. I wouldn’t If it’s not, find out from the seller why not — and where the users are coming from.

- Check for any duplicate counting of pageviews.

- Check the Behavior reports to see which pages are getting the most traffic. If a few pages are getting the majority of the traffic, it is more risky than if the traffic is well diversified. Also ensure that there isn’t a huge discrepancy between pageviews and unique pageviews.

Does the traffic come from from alternative sources like Facebook?

If the traffic comes from a source outside Google search, there are additional questions you should ask the seller.

Social media traffic (Facebook, Twitter, Youtube, etc.) requires a lot of work to keep up. So if a lot of the site’s traffic comes from social media, you will need to account for that additional work.

For instance, I once owned a site that got a lot of traffic from Facebook. In order to keep traffic coming, I had to spend a lot of money to constantly post new content for Facebook. Eventually, Facebook made algorithm changes that dropped the traffic significantly, reducing the value of my investment.

If you do consider a site that gets a significant percentage of its traffic from social media, make sure you understand the social media platform that they are using well, including the algorithm and the target audience.

Do the income and expense numbers look reasonable?

Before making an offer, you won’t be able to see any proof of income. But you will get to see the income as reported by the seller or broker. This means that you can’t really dig into the proof of income at this point. Still, there is some income due diligence that you can do.

First, you should do your own valuation of the site and ensure that the broker or seller’s valuation matches. If you aren’t comfortable with valuation yet, read our primer on how to determine a website’s valuation.

Assuming you have done a valuation and the site is properly priced, the next thing you should do is look through the seller/broker provided income statements for anything that looks strange or out of proportion. Since you should have Google Analytics access (see the previous section), you can determine the revenues per user.

For ad supported sites, RPMs (revenues per 1000 pageviews) should generally be $5-$40. Sometimes they can go higher than that (to $60 or more), but that’s not common. If you see RPMs that are abnormally high or very low, you should ask the seller for more information.

For affiliate sites, revenues per user can vary a lot more. But you can use your best judgement to determine if the numbers look reasonable. If a site is only getting 100 users a month and it’s consistently making $5000, something is not right. You should ask the seller for details before making any offers.

Can you make the same agreements as the seller?

Something a lot of buyers overlook is that affiliate partners and ad networks can be capricious. Just because the seller was able to get the site into a certain affiliate program or ad agreement doesn’t mean you will be able to.

[Keep in mind that the seller may have special deals with affiliates or ad networks, especially if they have multiple sites. Premium ad networks will often allow site owners to add sites that would not otherwise qualify, if they have a pre-existing relationship. And affiliates often negotiate higher rates with site owners.

Before making any offer, find out which agreements will be transferred with the site and which won’t. Those that won’t will need to be renegotiated, so you must make sure that you can renegotiate them.

If you are looking at an ad supported site, contact the ad network and find out what their requirements are, and whether the site will be able to re-qualify. If you’re looking at an affiliate site, check the affiliate’s rate card to ensure that the rates are what you expect. It’s also a good idea to speak with the affiliate partner to see if there is anything that would keep the site from being re-accepted into their affiliate program.

What are the growth trends of the site?

The growth trends for a website can show many things. Ideally, you want a gradual increase in sales and traffic. However, if you see profits stagnating over the past few months or years, the current owners either lost interest or were unable to market successfully. This is an excellent opportunity for you to step in.

Alternatively, a downward slope can spell bad news. A consistent decrease means that customers took their business elsewhere. Research to find out whether a competitor emerged on the market around this time. What did they offer that this website could not? Are you willing to put in the work to compete? Huge rises and falls mean the company took risks that worked, but they could not maintain them. Look into whether they spent a lot of money on marketing and ads during these highs.

Post-offer due diligence research

These are things you should generally do after you have an accepted offer for the website.

Do the sales and income statements match the seller’s reported numbers?

When a newbie thinks about due diligence, this is what comes to mind — and rightfully so. Checking a website’s income is extremely important. But how is it done? The method to check a site’s income depends on its income sources:

Ad supported sites

An ad supported site is generally the easiest to verify. Ad networks provide detailed reporting about how much traffic a site sees, as well as revenue numbers and other data.

If you are working with a broker, the broker will generally have printed (or PDF) ad revenue reports from the ad network. But it’s best to go beyond these and ask the seller to review the ad network’s reporting with you in real time.

Over Zoom or another conferencing tool, you can ask the seller to login to the ad network site and walk you through the reports. Have the seller go month by month and show you the pageviews, ad impressions, CPM, and revenue. Check that the revenue numbers match the seller’s reported numbers, and check that the pageviews are consistent with the Google Analytics reporting.

If you see that the ad network’s pageviews numbers are very different from the pageviews reported in Google Analytics, there may be a scam being perpetrated. When I see this, I immediately pull out of the transaction.

You may want to go one step further and ask to see bank statements showing that the earnings shown on the ad network reports are actually paid out. However, it’s rare that an ad network doesn’t pay, so it’s not absolutely necessary. I generally don’t bother looking at bank accounts in this case.

Affiliate sites

Affiliate sites can be a bit more difficult to verify than ad only sites, since they generally have multiple partners and less reporting available.

You will see monthly aggregate numbers from the broker or seller before you make an offer, but only after making the offer will you have access to the affiliate partner’s reports. A broker will generally already have printouts/PDFs of each month’s reports, but you should go a bit further.

Have the seller go through each affiliate partner’s reporting dashboard over Zoom and show you the monthly earnings. The dashboard will generally also show number of items sold and conversion numbers. The sales versus earnings can be checked against the pricing on the site and the commission schedule. You should also make sure that conversion numbers sound reasonable, and not absurdly high.

One problem with affiliates in general is that they are generally smaller than ad networks and may not reliably pay what is owed. Therefore, you can’t just assume that the amounts listed on the affiliate dashboards are actually paid out. You will want to see a seller’s bank account to ensure that the seller actually received the payments that were reported. And if some of the affiliates have not consistently paid, you should adjust the site’s purchase price accordingly.

Ecommerce sites

Ecommerce sites are the most difficult to perform income due diligence on. Payments made to the site may be on a variety of processors, and there are plenty of refunds, cancellations, and chargebacks that you must factor into your review. In addition, lags in payments can make reconciling all of this information a headache.

Again, if you are working with a broker, the broker will have printouts or PDFs of the payment processor’s reports. If not, you should ask the seller for these.

You can start your income due diligence research with these printouts and step through all of the calculations to ensure that the numbers are as expected. Doing your homework before talking with the seller helps you determine if something is suspicious and whether you need to ask more questions.

Once you have gone over the printouts/PDFs, have the seller walk through the payment processor dashboards on Zoom or another conferencing tool. Ask the seller to walk through each month’s earnings, as well as refunds and chargebacks. Then have the seller show you the site’s bank account with the deposits from the payment processor. Make sure the deposit amounts are consistent with what’s on the payment processor’s reports.

Are the expenses consistent with the seller’s numbers?

In addition to revenue, you should check expenses carefully. Generally ad supported or affiliate websites have the following types of expenses:

- Content creation (writers, artists, etc.)

- Hosting and software

- IT maintenance

E-commerce sites have additional expenses, such as product and fulfillment costs.

For most affiliate sites, hosting and maintenance costs will be negligible, since these sites don’t tend to get a lot of traffic. You can generally run them on a low-end 3rd party hosting plan, like you may get from Siteground or Cloudways. Ad supported sites, however, can end up costing a lot to host, since they (in order to make a reasonable amount of money) have much higher levels of traffic.

The big cost for affiliate and ad supported sites is content creation. The price for content creation can vary wildly depending on the type of content and the location and quality of the writers. I have paid anywhere between $1 per 100 words and $20 per 100 words, and some people will pay up to $1 per word, for specialized articles in technical, medical, or legal subjects.

Unfortunately, there is no easy guideline for how much content can cost, so I suggest asking the seller for the contact information of the writers. You can contact them and confirm that they wrote the articles for the prices disclosed.

Is there any intellectual property infringement?

An entire scam industry has sprung up around extorting small website owners for money for minor copyright infringement. This poses a real risk to website buyers because you don’t know how scrupulous the prior owner was.

A small group of creators and lawyers search the internet for images that they took, and if they find an image on your site, they will send you a threat. Even if the previous owner purchased the images appropriately, if you don’t have receipts, they will threaten you with a lawsuit. They will ask you for $1000 to $3000 to make the matter go away, or face a lawsuit with potential damages of $50,000+.

To protect yourself, request information from the seller about where the images are from. If the seller says he purchased them, ask for receipts. If they were public domain or free images, make sure the owner gives you information about their origin.

Text is easier, as you can find a few articles and run a plagiarism check on them. As far as I am aware, there is no similar extortion scam going on regarding text.

Is there written confirmation of any continuing agreements?

As I explained earlier, ad networks and affiliate programs can be capricious. The fact that the site was accepted before doesn’t mean it will be accepted again.

If the seller tells you that the agreements with ad networks or affiliates will be transferred with the site, have them get an email or some sort of written confirmation of that fact. Otherwise, you could be in trouble after closing.

Also, if the seller says that employees/contractors will continue to perform work on the site for the new owner, try to get a written confirmation of that as well. Employees and contractors have a habit of disappearing when a site is sold, and when they do remain, they may ask for an increase in pay.

If the seller is able to get an email from the employees saying that they will continue with the site at the same rate, you will have additional peace of mind.

Has the website faced any penalties or bans?

The number one rule of the internet is that you cannot scam Google — at least not for very long. Sites that use black hat SEO tricks, like keyword stuffing and cloaking, find their way onto a list. Once that happens, there’s no going back. In situations like these, a site owner may try to offload their site onto an unsuspecting victim. But do not be fooled.

Seeing a site’s Google Analytics should allow you to pinpoint any current penalties, since the site would instantaneously lose its search traffic. However, you should still ask to see the site’s Google Search Console, so that you can verify that there are no current or former penalties.

In addition to search penalties, you should check if the site is banned from Google Adsense. While being banned from Adsense isn’t a dealbreaker, most future buyers will want to know that Adsense can be used on the site, so you are best off ensuring that there is no ban.

There are tools online to check for an Adsense ban by URL, but these tools are extremely unreliable. The only way you can tell for sure is ask the seller to show you their Adsense account, or if they don’t have one, ask them to attempt to create one for the site.

What platform does the website use?

If you’re a non-technical buyer, the platform a site is on can be important. All platforms are not the same. To start, you need to understand the difference between CMS systems and hosting solutions and how they interact with hosting providers.

CMS systems

Content Management Systems are user-friendly tools that help you make, manage, and modify your website. All without any technical knowledge. Sites like WordPress, Joomla, and Drupal have gained massive popularity in this market. A huge reason why is because of how easy they are to use.

So, if you’re buying a WordPress based site, you don’t need to know how to code. As a result, you save money on tech support staff. CMS systems are also free and open source, which means you fully own your site. You can use free plugins, choose themes, add SEO settings, and choose your web host. Most hosting providers have a separate WordPress hosting plan along with their basic plans. Unlike regular shared hosting, this efficient design caters to the CMS user.

If the site you are looking to purchase is CMS based, find out what hosting plan it has, and what services it offers. Look into the monthly expense and potential costs to upgrade your plan or move your site to a different server.

Website builders

Another term you’ll hear is hosting solutions or website builders. If you use Youtube, you’ve probably come across a WIX ad a few too many times. Other options include Weebly, Shopify, and Squarespace. These web builders are easier to use, often give you constant support, and have built-in eCommerce features.

However, they are not CMS. Overall, they are less flexible and more expensive. But, that’s not the worst part for a website buyer. Not only do you not own your site’s design content, but you also cannot move to a new host without changing your web builder. Similarly, if you’re feeling trapped in the limited options your web builder offers, you’ll also have to change your hosting. Either way, the process is long, painful, and expensive. It involves moving your files, databases, and email addresses.

And all that’s assuming your domain isn’t registered through your web builder. Because if it is, you’ll have to change your URL, in which case none of your old links will work. Any previous customers trying to follow a Facebook link to your website won’t be able to find it. Your website will also drop in search rankings and Search Engine Optimization. Overall, this will create a world of mess for you.

Can you improve on the business?

While SEO deals with search engine rankings, marketing is directly responsible for selling products to customers. Add both these factors to content and product quality, and you have the trifecta of business success. Before you buy a website look at the related social media pages, what do they post on Facebook and Instagram? How often do they share information, and are their customers satisfied? Can you isolate clear steps to improve their strategy?

Alternatively, based on the product type and target market, would it be better suited to a different platform, say Pinterest? You don’t need a degree in marketing. Even a beginner can figure this out if they asks the right questions. All you need to do is look at the website’s marketing protocols. If you see a way to improve the site’s marketing strategy, you can increase profits three to four times. Sometimes it only takes an outside view and some creative thinking. So, if a website doesn’t have a strong brand identity, find a way to build one before buying it. In business, sales often improve with a change in management because of new ideas.

What is the target audience?

When it comes to generating leads and making sales, you need multiple sources for traffic. But, those sources cannot be tapped out. All of your profits cannot come from a specific group. The wider the base you can appeal to, the more buyers you can pull. Before you buy a website, you need to find out who their target audience is. And whether there is potential for growth.

To put this into perspective, compare four different business models.

- Website A appeals to two different groups but only succeeds in selling to 40 percent of each group. It is a good investment because you can still attract the other 60 percent and increase revenue.

- Website B appeals to two different groups that are tapped out. Profits are at a maximum, and no new clients can be pulled. There is no growth potential.

- Website C has customers in one group; however, you have identified a second untapped market. If you buy the website, you can market to them and significantly increase sales. It is a good investment.

- Website D also has clients in only one group, but there is no other potential. This severely restricts profits.

The current profits of the business depend on its existing audience. If you want to increase revenue, you need the website to have growth potential. Keep in mind that you cannot change the core audience for a website, no matter what else you do. Tumbler may try to attract businesses, but it will forever remain a space for high school and college students. If you don’t think you can sell products to the audience of a site, don’t buy it.

Understand the growth trends of a site

The growth trends for a website can show many things. Ideally, you want a gradual increase in sales and traffic. However, if you see profits stagnating over the past few months or years, the current owners either lost interest or were unable to market successfully. This is an excellent opportunity for you to step in.

Alternatively, a downward slope can spell bad news. A consistent decrease means that customers took their business elsewhere. Research to find out whether a competitor emerged on the market around this time. What did they offer that this website could not? Are you willing to put in the work to compete? Huge rises and falls mean the company took risks that worked, but they could not maintain them. Look into whether they spent a lot of money on marketing and ads during these highs.

Transfer due diligence

After you have closed on a website purchase, the seller will transfer the site and domain to you, and you have a small amount of time to review what has been transferred for accuracy and completeness.

The amount of time varies from a few hours to a day, and during this period you will need to review all of the material transferred and ensure that it is complete and accurate.

Make sure you have received all of these:

- The domain

- The website source code

- The database

- Any contracts or agreements

- Contacts for any writers, programmers, partners, affiliates, and ad networks

- The social media accounts

- The email and email list accounts

- The Google Analytics and any other analytics accounts

- The hosting accounts

- Any affiliate and ad network accounts

- Anything else you negotiated

Download the Due Diligence Overview worksheet

If you’re looking at a website to purchase, my Due Diligence Overview worksheet is a crucial tool to help you make a decision. And it’s available FREE — all you have to do is join my mailing list below. Along with great website investing content and tips, you’ll get the entire Website Investing Beginner’s Kit delivered to your inbox.

Key points

- check what platforms the site is using, CMS, web builder and hosting

- find out what the costs to change services would be

- look at site analytics to see if they’ve faced any penalties

- identify the target audience, sources of traffic and growth potential

- ask for analytical data to prove these claims

- ensure the site has steady growth trends

- inspect whether the SEO use is sustainable or trend-based

- evaluate marketing efforts and areas for growth

- look into the website’s running costs including staff and resources

- figure out why they’re selling their site

- research possible market competitors

- if you’re buying on a marketplace like Flippa, there are additional things to check

When investing in a site, you need to look at its financial history, current profit margins, and future potential. Keep these key factors in mind and you can’t go wrong.